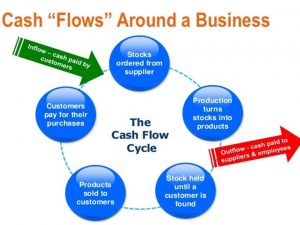

How to shorten the cash inflow process will be determined by how you manage your cash inflow and outflow. At one side we have activities that bring money into the business. Once we have delivered our service or stocks and invoiced the customer pays for that purchase. Then the whole cycle continues out of what the customer pays you pay your suppliers.

How you monitor your cash inflow and cash outflow is what we call cash flow management. Now there are sensitive activities that you must keep an eye on and these are activities that will avoid you going into negative cash position or rushing to look for money to fund operations. These are activities that you must keep an eye on, besides you delivering a good or service effectively and the customer is happy.

These activities revolve around the cash inflow;

- Customer billing and collection procedure; many entrepreneurs are very good at delivery, but very poor at collecting or following up their money. They feel like, they are having a bad day when following up but are happy to deliver and forget about it. That is wasteful for your business when it terms of managing cash flow.

The effective principle is that immediately you deliver you should collect or follow a well laid out collection/invoicing procedure. Your team should the aware of the invoicing procedure. The ideal process is to invoice as quickly as possible after delivery.

Now what happens after invoicing is also very sensitive. Some customers will say they never saw your invoice, or say they only pay after 30 days of delivery of the invoice. That means when you delay to send the invoice you also delay the payment date. You need to quickly invoice and constantly follow up.

Make sure you follow up to make sure that the invoice was received by the right person. Some customers you don’t want to pay quickly so they will receive the invoice but will keep quiet and pretend they never received the invoice.

- Introduce rewards for customers who pay early; probably you give them a discount that should also go out in the invoice e.g. if they pay within the first 10 days for a 30 day invoice you will give them a given discount amount. By giving them flexible payment terms the customers will pay early. For customers who delay you could charge an interest but make sure you capture this in the invoice.

- Background check; if you have a sales team ensure they carry out a background check of a potential customer before closing sale deal. Probably this customer never pays and has a known history of refusing to pay. A background check could be very easy if you already know each other in the same industry.

- Make sure that you look at the financial soundness of the customers that you engage with because you don’t want to engage with customers who take you round.

- Make payment flexible; do not complicate payment process by insisting on a given payment method e.g. somebody must pay using a cheque. Make it easy. Let the invoice go out indicating various payment options for the customer to use. Seam less for the customer.

- Remind customers of money owed by issuing monthly statements; Make it a habit to send monthly statement. Remember, if you’re using an accounting system, this can be automated. The accounting system make it easy automate; regularly send payment reminders to these customers, because when you become consistent with the customer, that’s when the customer will pay you. This will determine how to shorten the cash inflow process.

Roles of an Entrepreneur in Cash Management

As an entrepreneur, you have five cash management roles. These are:

1) Cash finder – the first priority of the entrepreneur is to ensure that there is enough cash to pay all the bills. It’s an on-going process that requires consistent monitoring of the cash flow position.

2) Cash planner– the entrepreneur should track cash and plan on how the business will meet the future cash flow needs. This is achieved with the aid of a cash budget that forecasts the company’s cash in-flows and out-flows for the period ahead.

3) Cash distributor– for the business to remain solvent its important for the business owner to control the disbursement of cash towards paying the business bills through timing and prioritizing of those payments.

4) Cash collector– as cash collector, the entrepreneur should not only pump up sales but should follow up to ensure that customers are paying bills on time. Frequently entrepreneurs neglect collecting cash after making sales. It is important for entrepreneurs to dedicate resources towards collecting account receivables as this is critical to the business having cash available to run operations.

5) Cash conserver– it is your role as a business owner that you get value for every shilling spend. When buying assets or procuring items for use in the business ensure that you asset you are purchasing will give you more or equal benefits to the cost that you are incurring. Any expenditure that is not core to running the business should be avoided.

Conclusion

How to shorten the cash inflow process is determined by how you manage both cash inflow and outflow activities. Cash flow is important in the growth and success of any business, sustaining everyday operations, expansion and purchasing power. Is cash flow more important than profits? It might just be!