Do you understand financial statements? Financial statements are generated from the accounting system. It is the data input in the accounting system that will determine the output that you get. When you feed the accounting system with the wrong information, it generates incorrect reports for you. Even if you delegate the role of entering data into the accounting system, you have an oversight role as an entrepreneur to ensure that the data that is fed is a true and fair representative of what your business is.

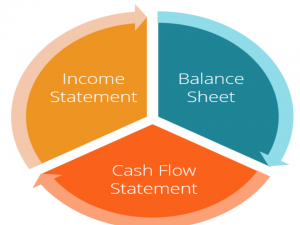

Do you understand financial statements? Three financial statements are generated out of the accounting system. These are the income statement, the balance sheet and the cash flow. A financial statement shows where the company money has come from, where it went, how it was used and where it was used. Before we look at the financial statement details we need to know what the income statement shows what the balance sheet shows and what the cash flow shows; there is need for us to understand the importance of financial statements? Why does your bank always ask you for financial statement? Why when you want to get a loan, when you are looking for investors, they ask for your financial statements and the quick things to look at? The reasons they ask for your financial statements are:

- As outsiders, they are quick to pick out the performance of your business whether it has been increasing or decreasing by analyzing your statements. That is why it is important for you to ensure that whatever information is fed into the system is a true reflection of what is happening in the business because the financial statements are the ones that give the story.

- They use the financial statements to measure the value of your business. Some of us probably would want to get investors onboard or sell off our company. How do you quantify or value your company and say my business is worth this much. You need to pay me this much or you need to invest this much or you need to buy shares at this amount. This can be determined using the financial statements, because it will have captured the growth journey of how the business; these are the revenues that have been made month by month; these are the expenses that we have been incurring. With these data the investors are able to value your business very fast as a result of looking at the financial statement.

- The financial statements help in evaluating your tax liabilities. The tax liability is as a result of how have you have traded, how much has remained as profit and that is what is subject to corporate tax. The financial statements help you in evaluating the tax position.

- Helps an entrepreneur make informed decisions. As a business owner, it helps you make decisions. You are always making decisions for your business every day. Do I buy more? Do I decrease my expenses? Do I increase my revenue? Do I expand? Do I go to another region? Those decisions can be made based on the financial statements. And that’s why it’s critical for your accountant to give you this report, every month.

Now, after understanding the importance of the financial statements, let’s look at in depth, the separate financial statements.

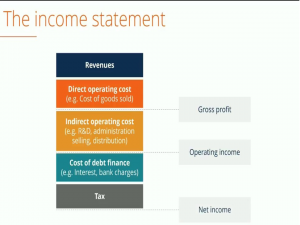

Income Statement

A income/profit and loss statement is a statement that gives a summary of these are the sales and expenses for a given period and what has remained as either profit or loss. It’s a simple framework that shows the sales made as a business, what was paid out in the process of generating the sales and what remained. It is for a specific period, it could be an income statement or profit and loss for one, two months, quarterly or yearly. You need to define the period that you want to review.

It begins with the revenue then direct operating expenses. A lot of businesses may have direct operating cost. Some businesses may not have a lot of direct operating costs. Direct operating costs is the cost that relates to you producing those sales, that if you never incurred that cost, you would not have produced the sales. For example if you are into manufacturing, and the workers never came to work, you would not have generated the product to sell.

After you subtract your direct operating cost from revenue you get the gross profit. This is the money that has remained for you to use to pay the indirect operating expenses. These are expenses that are used to run your businesses. Whether you make the sales or not, you have to incur them. A lot of these indirect expenses are expenses around administration, utility, rent, telephone, etc. Now, beyond that there are other businesses who also have interest, probably you’re paying interest on a loan and bank charges.

When you less the indirect operating cost from the gross profit you get the operating income. Once you subject the operating income to cost of debt finance and tax liability you get net income. That’s the general layout of how an income statement should look like.

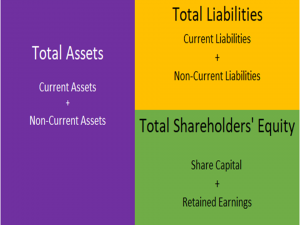

Balance Sheet

It shows how much you own (assets) and how much you owe (liabilities). It also indicates the net worth (equity) which is the difference between the assets and liabilities.

Under assets we have two types of assets, current assets and non-current assets. Current assets are assets that you can quickly be liquidated; converted into cash. When we say quickly, probably less than a year e.g. stocks, debtors. Non-current assets are assets that will take more than a year before you convert them to cash e.g. land and buildings that will take so much time for you to dispose and convert them to cash.

Looking at liabilities we have current liability and non-current liabilities. Current Liabilities are liabilities that you need to pay for duration of less than a year e.g. dividends which are normally paid within a period of less than one year. So they will fall under current liability as dividends payable. Long term liabilities you need to pay beyond an year e.g. a business loan for five years. The other part of the balance sheet is what we call the shareholders equity.

This is the money that the shareholder/business owner has invested in the business. Shareholders equity is made up of two elements i.e. the initial money that you invested and funds injected or profits ploughed back into the business over time. There’s what we call retained profit or retained earnings. This is profit that you earn in year one, then you decide to plough it back into the business instead of withdrawing it from the business.

Cash Flow Statement

The cash flow statement shows the liquid cash available in the business after all the cash inflow and outflows in the business. The cash flow statement comprises of three main categories; operating activities, the investing activities, and financing activities, all these activities make up the cash flow.

Cash flow from the operating activity is cash that results from business activities of the trade that your business engages in e.g. cash inflow from selling of goods or services, cash outflow from expenses; paying the staff, rent, supplies, dividends. It’s the cash position that results from the operating nature of a business.

Investing activities; this is cash flow that results from the business investing. Probably the business bought shares, or things that generate income and bring it back to the business. It is using these assets as an investing vehicle to add another revenue stream.

Financing activities; this is money that a business has gotten out of the financing or incurred e.g. getting or paying loans, grants, an investor who has come on board and acquired equity etc.

Check out financial statement case study with figures.

Causes of Differences between Cash flow and Profit

A business can have a positive cash flow while having no profit if the cash comes from sources other than income. Conversely, a company can have negative cash flow while having a large profit. Do you understand financial statements? These differences can be caused by:

- Business owner contributions/balance sheet items; such as when an owner puts in their own money or if they take out a loan; acquiring or paying a loan; asset purchase or disposal etc. These types of transactions are not income statements items and appear on the balance sheet as they are liability or equity transactions.

- It could be that the business is profitable but due to credit terms, the business is losing cash each month as customer hold onto the businesses’ money. Equally it could be that the business is generating more cash than profit due to favorable terms from these supplier.

Who is interested in the Financial statements?

A lot of people have vested interest in your business especially if you’re looking to grow. That is why you see a lot of businesses even declaring their profit and loss statement publicly in the media. Why would they have to do that? Because it’s an obligation, they have an obligation to their investors, who have invested money in the company. The customers are interested in the financial statement, they want to know whether they are closing the next day, or going into liquidation.

The customers want to know whether the business is a going concern. The suppliers would want to know if they supply? Are you capable to pay? Do you have the liquidity? Do you have the financial muscles to pay?

The government is interested because the government needs to know how much money you make so that you can pay taxes. Other interested parties include competitors, lenders, employees etc.

Conclusion

Do you understand financial statements? Understanding how your business is performing allows you to make better informed decisions that could mean success and growth for your business. Delegation of the accounting function does not mean you neglect your oversight role as an entrepreneur. Thus, it is paramount for every business owner to have enough knowledge on how financial statements work.