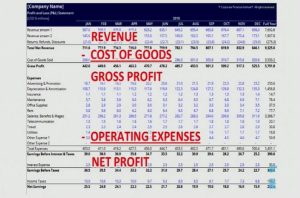

How to measure customer lifetime value involves dealing with entrepreneurship financials and the unit economics of customer lifetime value, and cost of customer acquisition. The best way to understand the concept of customer lifetime value is by looking at an example of a typical profit loss statement to understand why lifetime value is important and where it fits because it determines the ratio of lifetime value to the cost of acquiring a customer. Find below a typical profit loss statement that has revenue, then we subtract out the cost of goods, and we have gross profit, that gross profit number is a very key number.

That gross profit then allows us to pay all of our operating expenses. When we look at the lifetime value of a customer, we’re interested in the gross profit that the customer provides to pay the operating expenses during their lifetime with the business, and then we end up with some net profit.

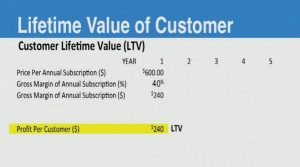

Find below what the lifetime value of a customer looks like conceptually. It’s how much a new customer is worth to your venture in gross profit over the lifetime with you, and we’re going to use a number of five years. This is how to measure customer lifetime value. The equation is lifetime value equals the sum of the gross profits over five years.

LTV = Sum of Gross Profits for 5 years

Some key considerations that we have to look at are;

-

Gross margins (Average Selling Price – Cost Of Goods) = GROSS PROFIT

It’s the average selling price, minus the cost of goods, which equals the gross profit. How do we find the average selling price? We total up all the revenues divided by the number of sales, and we have the average selling price, which we subtract from the cost of goods and end up with gross profit.

-

Ability to up-sell or capture additional revenue

Then can we up-sell the customer or add additional revenue to make that customer worth more value? Note that it’s gross profit that matters, not the revenue; we have to take revenue minus cost of goods equaling our gross profit. This is how to measure customer lifetime value. Find below a simple illustration of what lifetime value of a customer looks like for a company called Bentrix.

Now, taking out all the numbers for years beyond one because we want to see, if they were just going to sell one thing, what would the lifetime value look like? Here, let’s say that they’re selling just one subscription per year for their services, and there’s not going to be anybody coming back, or they are a company that just sells one product. They sell it for $600, their gross margin is 40%. That means their cost of goods is 60%. They get to keep 40% of that $600, which is $240. $240 is the lifetime value of the customer for a single sale. It’s easy to calculate a lifetime value for a single sale.

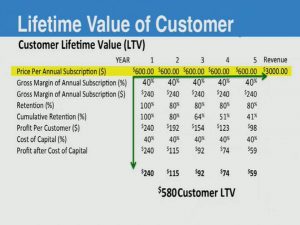

For many companies that have reoccurring revenue, like what Bentrix is, the calculation becomes more complex. Let’s re-look at the conceptual concept of lifetime value. Lifetime value is equal to the sum of the gross profits over five years.

LTV = ∑ Gross Profits for 5 years

Even though we’ve looked at the gross margin and the ability to up-sell, if we have reoccurring revenue, we have to add a couple of things to the equation.

-

Retention rate for reoccurring revenue (cumulative)

We have to add the retention rate because if people renew every year, we have to calculate that renewal rate. Or if they don’t renew, we call that the churn rate for reoccurring revenue, and it’s cumulative.

-

Cost of capital

Then we also have to look at the cost of capital, and we’re going to find out that the cost of capital is not cheap for a startup organization. Let’s look at the same graph again with the rest of the years filled in for Bentrix.

Here we see an annual subscription fee of $600 over five years equals $3,000 in revenue. Some people would say the lifetime value of that customer is $3,000, it’s not even close. That’s the revenue, and revenue is not cash and is not lifetime value.

If we now look down and walk through this process, it’s the same on the first year, they have a 40% gross margin and they get to keep 40% of the 600, which is $240.Their retention rate is 100% the first year because everybody just signed up, and their profit is $240. Then their cost of capital is 40%.

The average cost of capital for a startup is between 35 and 70%. The cost of capital is not your interest on the loan, it’s how much of your profit you use to pay a loan. Whatever your gross profit is, out of that gross profit, you have all the operating expenses that you have to pay.

Well, if you pick up a loan, you’ve got to pay that loan out of that gross profit as well. They got to take that money away; it’s no longer available for the operating expenses. The average amount of gross profits spent on the loan is between 35 and 70% of your gross profit. Borrowing money is expensive.

It’s not that you can’t pay it; it’s that you lose that money to pay your operating expenses. You have to be careful how much you spend on the cost of capital. In this situation, their cost of capital is 40%. We’re not going to pay anything back out of this first year just to make the equation calculation easy, maybe you’ll do monthly payments, but in this example, no payments for the first year.

They still get to keep all the money, $240. Second year, where we start to see all of the stuff kick in, that’s cumulative $600 annual subscription minus 60% cost of goods, they get to keep 40% which is $240. Now they have an 80% retention rate.

That means 20% did not renew. They get to keep 80% of that $240, they’re at 192. Their cost of capital is 40% and so they lose 40% of that and get to keep 60%. They end up with 60% of 190 to arrive at $115. If we look at the third year again, 40% gross Margin, they have $240 that they make.

Now, they only get to have 80% of the 80% that was there last year, which gives them a cumulative total of 64% of retaining customers. 64% of that $240 is 154 and they still take out the 40% cost of capital, which means they get to keep 60% of that 154 arriving at 92. This goes on through the rest of those years.

What we see at the bottom is we add up all of their cost of their lifetime value of the customer and end up with $580 radically different than 3000. They’re impacted by the cost of capital and the retention rate. It’s a more complex equation.

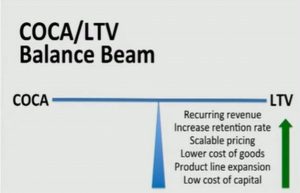

How do we increase lifetime value of a customer?

We increase the lifetime value of a customer by:

- Recurring revenue

One of the ways is reoccurring revenue. We have from the example that with a single sale at $600 we only had a value of that customer of $240. But if we resold them a subscription every year, the value went up, even though the amount of it was decreasing every year because of cumulative loss or churn and cumulative ongoing cost of capital.

- Increase retention rate

Then if we increase the retention rate, we have more value.

- Scalable pricing

When we raise our prices, we have more life-time value.

- Lower cost of goods

Lowering the cost of goods gives us a greater gross profit margin, and that helps lifetime value.

- Product line expansion

We sell them more product by expanding our product line.

- Low cost of capital

If we lower the cost of capital or eliminate the cost of capital, then obviously our life value is worth more, meaning there’s more gross profit available to pay the operating expenses.

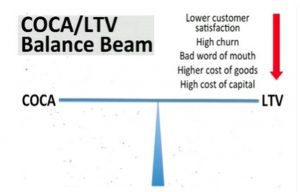

How do we decrease lifetime value of a customer?

We decrease the lifetime value of a customer by:

- Lower customer satisfaction and which increases churn rate.

- Bad word of mouth – Bad word of mouth leads to people not buying, thus you have fewer customers.

- Higher cost of goods – Lowers your lifetime value because you sell it for a certain amount. If you raise the cost of goods, then your gross profit is less.

- Higher cost of capital – If you’re using and borrowing money.

Conclusion

How to measure customer lifetime value involves being able to know the cost per unit of your product or service and how many times a customer purchases that unit. It is different from revenue because it is based on gross profit realized per customer for their lifetime with the business.

Retention rate and the cost of capital are great determinants of customer lifetime value.