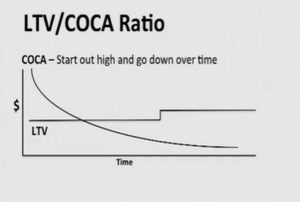

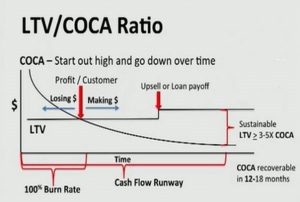

We will be looking at lifetime value (LTV), and cost of customer acquisition (COCA) ratio, which helps us understand the health of our organization and the time to sustainability. Find below a graph that shows the coca and the LTV amounts and will help us understand how to calculate LTV/CAC ratio.

This graph is pulled out of a budget and spreadsheets of a company called Bentrix. In the initial stages, we haven’t launched yet, we’re still trying to project if our organization is sustainable. Down the road, we’re going to take actual numbers as we launch the company and start rolling. For now, these are projections.

You notice that the cost of customer acquisition starts out high and goes down over time. Why does that happen? Why is COCA so high? It’s because we have to spend money to make money, we have to spend money to acquire customers before we get them, and they start generating revenues. The cost of customer acquisition starts off high but goes down over time.

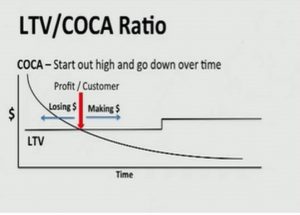

What does this crossover point mean on the graph? This is profit per customer. The time before that crossover occurs, we are losing money on every customer; it’s actually costing more to get them than the amount of money that we’re making. Then after that period of time, we’re actually starting to make profit per customer. That doesn’t mean our company’s sustainable; it means we’re making profit per customer.

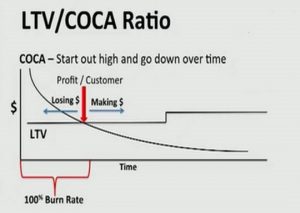

If we look at this time frame, it indicates that before we crossed that period of the cost of customer acquisition dropping below the lifetime value, 100% of all the money we needed to run the company before that period of time is coming from somewhere else. The family, the friends and out of your pocket, unless we’ve gotten professional funding. 100% of the money we’re spending to run our organization is not coming from profit from customers, it’s coming from somewhere else.

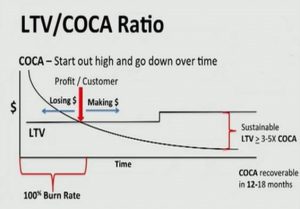

Now, somewhere down the road, we’re going to achieve a ratio of 3x to 5x between the lifetime value in the cost of customer acquisition. That is where our company actually becomes sustainable. Lifetime value has to be three times greater than the cost of customer acquisition for a software as a service company.

If you’re a product or a service company, lifetime value has got to be five times greater than the cost of customer acquisition; if you’re a product or a service company that has a lot of staff. Ultimately, when we get out there, we want to be able to recover our cost of customer acquisition in 12 to 18 months, that’s ideal.

That whole timeframe to get out there is how long that’s going to take. That is our total cash flow runway that is typically three to five years to create or to achieve sustainability. Most organizations take two to three years of running in a burn rate that’s negative.

Meaning they have to get money from somewhere else. Even over that whole three to five-year period, until you get all the way out there to that sustainability point, you have to get some money outside of just customers because the ratios are not high enough. This ratio is a really important number. That uptick is where we either sell another product or service to a customer and they become worth more or pay off a loan.

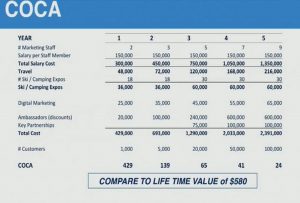

Let us look at an example with a company called Bentrix to further help us understand how to calculate LTV/CAC ratio.

Looking at their costs of customer acquisition, we see that over these years, they are hiring two to three to five to seven to nine sales people. They’re spending a lot of money on marketing, their total costs and marketing go from $429,000 to $693,000 very rapidly.

Looking at how many customers they get. The first year they get 1000 customers into a $429,000 spent on cost of customer acquisition, each customer costs $429. The following year, they get 5000 customers into a $693,000 spent; now we’re down to $139 a customer, and by year three they are at $65 to acquire a customer.

If their lifetime value of a customer is $580, where does Bentrix become sustainable? Remember, they’re not just a software as a service company because they had to buy products; all the rental equipment, they had to deliberate. They need a ratio of five to one; lifetime value of five times the cost of customer acquisition, to be able to be sustainable. Where do they become sustainable in this graph?

Are they sustainable in year one? Not at all. Are they sustainable in year two? Well, 5 times 139 rounded off would be 700. They’re still not sustainable. At year three;five times $65, that 5x would be $325. They are starting to move towards sustainability.

They’re making $580; that is way over $325. Somewhere between year two and three, Bentrix actually becomes sustainable. By looking at that ratio between them, we get to understand the health of the organization.

How Cost of Customer Acquisition Affects Valuation

This new mathematics has totally changed the valuation of companies and how people think. A good example is Facebook; they bought WhatsApp not too long ago with 55 employees and paid $19 billion dollars. Why did they do that? It would have been nice to have been one of those 55 employees.

Well, they did it because they ended up buying 415 million users. The average cost to get a user online, even if you’re doing Google AdWords or Facebook boost ads, could be $100 or more; cost of customer acquisition. They bought 415 million users at a cost of less than $50 a user.

It was the cost of customer acquisition. That was the big issue here with Facebook buying WhatsApp; the cost of customer acquisition changes the valuation of the company. They were actually buying the customer, and the Low Cost of customer acquisition increased the valuation of WhatsApp. That is why it is important to understand how to calculate LTV/CAC ratio.

Conclusion

It is important to understand how to calculate LTV/CAC ratio has it will inform when your business has become sustainable. As mentioned in the article, it can increase the valuation of your company, especially if you have a low cost of customer acquisition as a company.